“Smocca,” a Rental Property and Apartment Search Portal Site Operated by ZIGExN, Has Released the “Tokyo Area Average Rent and Price Change Rate Rankings”

Rents Rise in 61 Areas for Singles, Drop in 30% for Families

“Chintai Smocca” (hereinafter referred to as Smocca) https://smocca.jp/, a rental property and apartment search portal site operated by ZIGExN Co., Ltd. (Headquarters: Minato-ku, Tokyo, Representative Director, Operating Officer, and CEO: Joe Hirao, Tokyo Stock Exchange Prime: 3679, hereinafter referred to as ZIGExN), has released the “Tokyo Area Average Rent and Price Change Rate Rankings.”

This ranking is aggregated from property data of 65,540 listings across 63 areas within Tokyo’s 23 wards, which were featured in the four installments of the “Tokyo’s Child-Friendly Area Ranking” series:

・“Central 6 Wards Edition” (https://zigexn.co.jp/en/12023/)

・“Joto Area Edition” (https://zigexn.co.jp/14127)

・“Josai & Johoku Area Edition” (https://zigexn.co.jp/en/12167/)

・“Jonan Area Edition” (https://www.zigexn.co.jp/14475/)

This release summarizes average rents and rent change rates by area in a ranked format. It is intended for those considering relocation, comparing multiple candidate areas to find the best fit, or seeking to understand the current rental market in their areas of interest.

(*Data aggregation dates: April 10, 2024, and April 10, 2025)

■About Layout Classification

The layouts of properties used in this aggregation were categorized into three groups according to lifestyle:

・For One Person: 1R, 1K, 1DK, 1SLDK, 2K, 2DK, 2LDK

・For Two People: 1LDK, 2K, 2DK, 2LDK, 2SLDK, 3K, 3DK, 3LDK

・For Families: 2LDK, 2SLDK, 3K, 3DK, 3LDK, 3SLDK, 4K, 4DK, 4LDK and larger

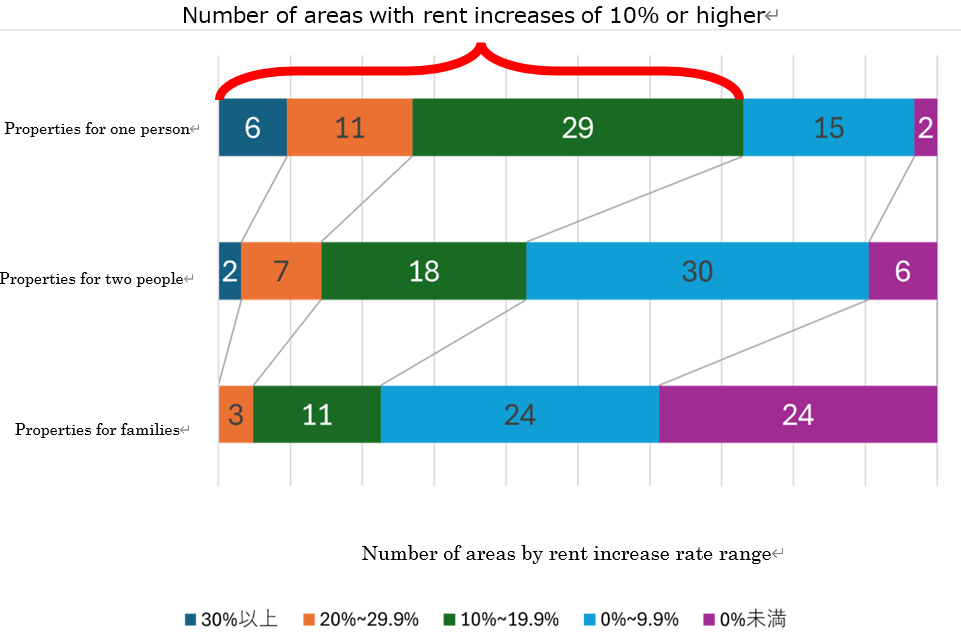

■Rent Change Rates within Tokyo’s 23 Wards

This survey found that rents have increased year-over-year across many areas and layout types. This trend is attributed to a population return to the Tokyo metropolitan area following a temporary downturn in the rental market caused by the COVID-19 pandemic, as well as an increase in the supply of newly built properties.

The chart below summarizes the rent change rates by household type (YoY), based on property information registered in the Smocca database.

・Properties for one person saw an average rent increase of 15.8%. Among these, six areas recorded rent growth exceeding 30%.

・Properties for two people experienced a relatively moderate increase, with an average rise of 9.2%.

・Meanwhile, properties for families saw rent declines in 24 out of 63 areas (30%). Nevertheless, the overall average rent increased by 2.8%.

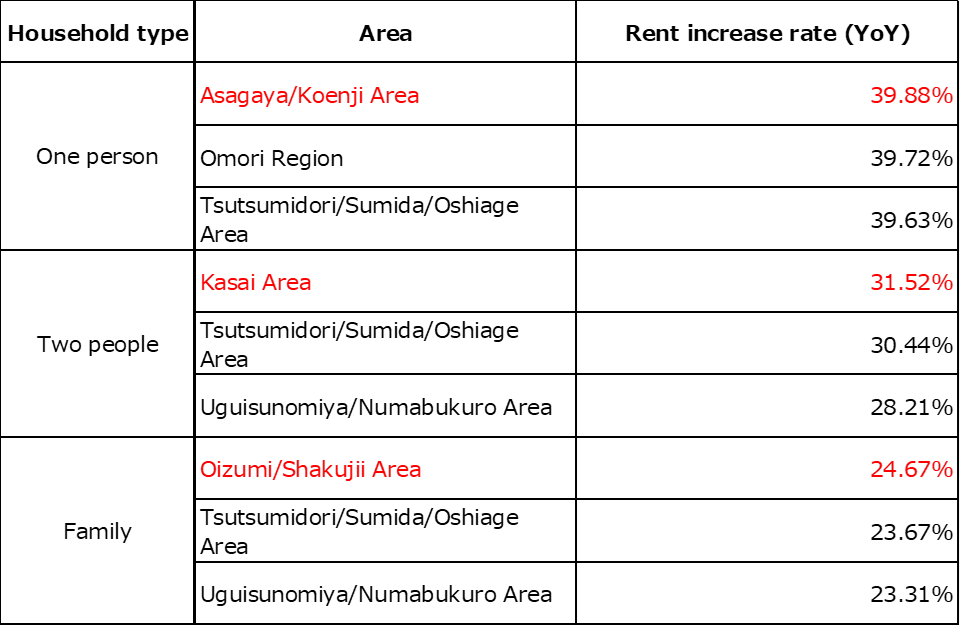

Next, we will introduce the top three areas with the highest rent increases for each household type.

The top area in each household type is highlighted below, along with an explanation of the background and key factors behind the rent increases.

Asagaya and Koenji Area

In Suginami Ward, the population has been on the rise, with single-person households increasing for five consecutive years (*). The average rent for properties suited to single occupants ranks 48th out of the 63 areas analyzed, indicating relatively affordable pricing.

This area offers excellent access to central Tokyo. Koenji (https://smocca.jp/livability/tokyo/station/2199340) is known as a hub for subculture, vintage fashion, and music, while Asagaya (https://smocca.jp/livability/tokyo/station/2199350) features a charming, laid-back shopping street. These unique characteristics appear to be attracting more single-person households to the area.

Additionally, the area received a high user rating on Smocca, with an overall score of 4.14, placing it among the top-rated locations. This growing demand may have tightened supply, contributing to the rise in average rent levels.

*Source: Suginami Ward Statistical Report 2024, Section 2: Population

(https://www.city.suginami.tokyo.jp/documents/19976/r6-2.pdf)

Kasai Area

With direct access to major business districts such as Otemachi and Nihonbashi via the Tokyo Metro Tozai Line, this area offers excellent transportation convenience. It is also surrounded by lush green spaces, including Kasai Rinkai Park, enhancing its appeal as a residential environment.

While the rent increase rate for two-person households is relatively high compared to the overall average, the actual rent level remains the 15th lowest among the 63 areas analyzed, making it more affordable than central Tokyo. Amid rising rents in the city center, demand from couples seeking larger properties within budget appears to be concentrated here.

The combination of “affordable rent” and “convenient access to central Tokyo” makes this area especially attractive to cost-conscious residents. As such, it is increasingly seen as a compelling “next option” for those considering a move.

Oizumi and Shakujii Area

Located in the western part of Nerima Ward, this area is known for its tranquil and green residential environment, featuring large parks such as Shakujii Park and Oizumi Central Park. It also offers convenient access to major city centers like Ikebukuro, Shinjuku, and Shibuya, while maintaining relatively moderate rent levels.

Nerima Ward (https://smocca.jp/livability/tokyo/city/13120) is also recognized for its strong support for child-rearing, having achieved zero waiting lists for nursery schools for four consecutive years. With a well-developed educational environment, the area has earned high marks among families.

Traditionally, a neighborhood with many detached houses and condominiums, the recent surge in property prices has led some families to give up on home purchases and turn to the rental market instead. This shift has driven up demand, resulting in higher rental prices.

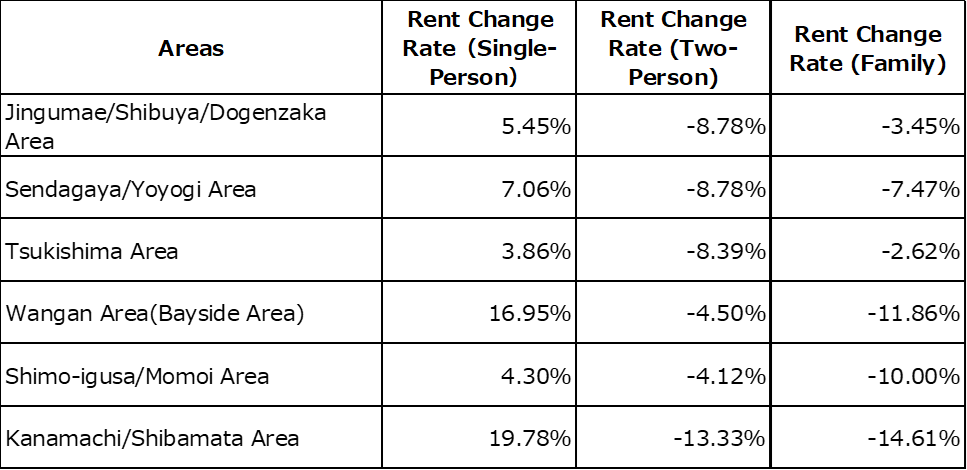

■Trends in Rent Changes by Household Type

Across the 23 wards of Tokyo, rents have generally been on the rise. However, when examining rent changes by household type, it was found that while rents for single-person properties have increased, several areas saw rent declines for two-person and family-sized properties. Below are six areas showing significant gaps in rent fluctuations among household types, along with an analysis of the factors behind these differences.

Jingumae, Shibuya, and Dogenzaka Area / Sendagaya and Yoyogi Area

These areas are among the most expensive within the 23 wards, featuring numerous high-end condominiums and rental apartments. Although there is steady demand from couples and families, the high rent levels are seen as a barrier to choice. Even when potential demand exists, once rent exceeds a certain threshold, it is often deemed to lack cost-effectiveness, prompting many to consider relocating to more affordable areas nearby. As a result, a rebalancing of demand based on budget considerations may be occurring, potentially leading to downward adjustments in rent levels.

Tsukishima Area / Wangan Area

In these rapidly redeveloping areas, the supply of new family-sized properties has surged. This oversupply appears to be contributing to a decline in rents. Particularly with the full-scale handover of properties like Harumi Flag and Park Tower Kachidoki underway, prices for resale condominiums in the Bayside area are also trending downward, attracting attention as the “Wangan 2024 Issue.” While large-scale redevelopment is expected to enhance long-term asset value, it is important to note that in the short term, rent adjustments due to oversupply are likely to occur.

Shimoigusa and Momoi Area / Kanamachi and Shibamata Area

Although these areas are somewhat distant from central Tokyo, they offer both good access and a quiet residential environment. Rent levels are relatively affordable compared to the 63 areas surveyed, which is believed to drive increased demand from price-sensitive single-person households, such as students and young professionals. On the other hand, couples and families may find other areas within the same price range that offer better living environments and school districts. This mismatch is likely contributing to localized demand shortages, which in turn may be causing rent declines in these areas.

■Summary

Rents across Tokyo as a whole have shown an upward trend, driven by factors such as population returning to the metropolitan area and increased supply of new properties.

Notably, rent hikes were especially pronounced for single-person properties in the Asagaya and Koenji areas, as well as across all household categories in the Tsutsumidori, Sumida, and Oshiage areas. Conversely, in areas with already high rent levels, such as Jingu-mae, Shibuya, Dogenzaka, Sendagaya, and Yoyogi, rents showed a slight downward trend. Additionally, in the Tsukishima and Wangan areas, rent adjustments appear to be underway due to oversupply caused by redevelopment.

By analyzing rent levels at a more detailed area level rather than just by ward, it has become easier to make decisions that reflect actual livability and pricing. This report is intended to serve as a useful reference for those selecting areas when searching for properties.

====================

【Aggregation Method】

This analysis covers a total of 65,540 property listings across 63 areas within the 23 wards of Tokyo. Properties were categorized into three household types: single-person, two-person, and family property. Average rents and year-over-year price change rates were calculated for each category.

・Data aggregation dates: April 10, 2024, and April 10, 2025

====================

■About “Chintai Smocca”

Chintai Smocca is a rental search website that allows users to browse rental housing from a database of approximately 5.5 million properties. It aggregates property information listed on various rental information services. The property listings are updated daily, enabling users to easily find fresh rental property information from all over Japan.

[URL]https://smocca.jp/